Christine Ciullo and Jjuan White

Essentials first: what today’s value-driven consumer means for retail in 2026

Toluna’s latest shopper & retail tracker study explores the evolving retail behavior landscape in the US. Based on a national survey of 2,500 U.S. primary shoppers fielded in late 2025, the study paints a clear picture of a consumer under pressure.

Inflation and rising grocery costs are reshaping household budgets, pushing shoppers toward more value-driven behaviors and redefining how they choose where, what, and how to buy.

Our findings offer timely guidance for retailers and brands as they begin planning for 2026 and beyond.

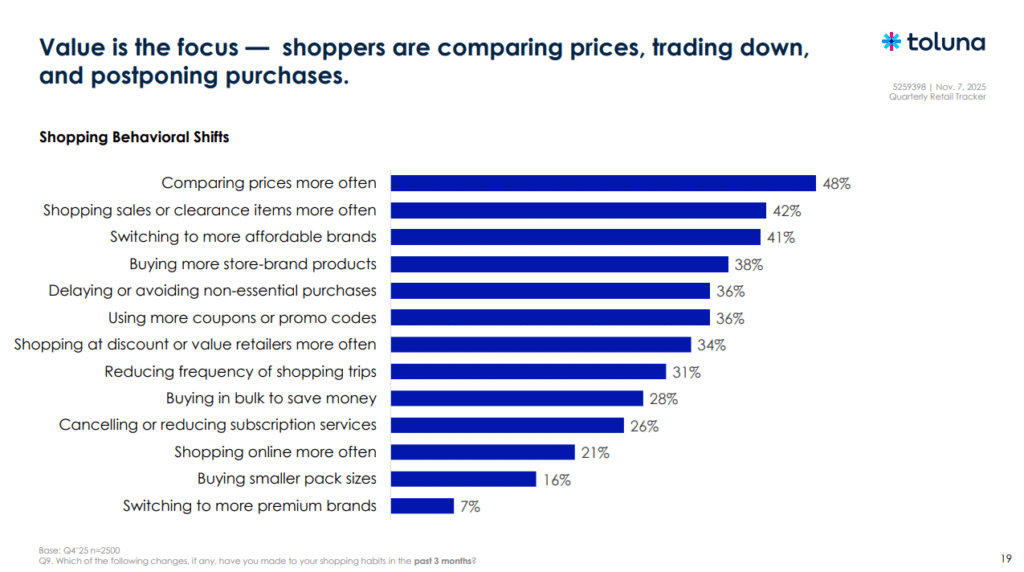

Value-seeking behavior intensifies

Shoppers are actively trying to stretch their dollars. Over half of American shoppers report increased household spending over the past three months – not due to indulgence, but because everyday costs are higher.

As a result, consumers are comparing prices more often (48%), shopping sales or clearance items more often (42%), switching to more affordable brands (41%), increasing store-brand purchases (38%), and delaying purchases of non-essential, discretionary items (36%).

These behaviors are most pronounced among Gen Z and Millennials, underscoring how younger shoppers are adapting the fastest to economic strain. However, Gen Z are also the least likely (28%) to switch to store brands.

Essentials dominate wallet share

Essentials continue to command the largest share of consumer spend. Food, beverages, personal care, and household products top recent purchases, while discretionary categories including electronics, home projects, and media are seeing cutbacks. Apparel is also seeing a higher percentage of decreased spending for many households, with 52% of shoppers reporting cutting back their spend in the category. The one exception is Millennials, 74% of whom continue to spend in the apparel category.

When spending does increase, it is largely confined to necessities, reinforcing that growth opportunities for brands currently lie in everyday categories rather than big-ticket or impulse-driven ones.

Price & proximity over experience and values

When it comes to store choice, practical factors dominate. Price (55%) and proximity (51%) are the top drivers for shoppers, outweighing experience, brand values, or emotional connection. Mass, grocery, and discount retailers capture the majority of shopping trips and wallet share, while online and club stores form a secondary tier.

In general, consumers say they choose stores that are affordable and convenient, avoiding those that are too expensive or too far away. Experience matters at the margins (more so for Gen Z), but value wins the majority (for Boomers especially).

Social media’s mixed role in shopping

Social platforms increasingly influence discovery and purchase, particularly for clothing, personal care, and beauty. Facebook, YouTube, TikTok, and Instagram top the list of social sites generating shopper visits. Unsurprisingly, Gen Z and Millennials are the most likely to shop for personal care, beauty, and health & wellness on social platforms.

While many shoppers agree that targeted ads help them discover relevant products, there is also a rise in fatigue: a sizable share of consumers ignore most ads (57%) or find them annoying (52%).

The takeaway for brands and retailers is clear: social works best when targeting is precise and content feels genuinely useful.

Holiday retrospective and looking ahead

Nearly half of shoppers started holiday shopping early in 2025, and most expected spending to remain flat versus 2024. Walmart, Amazon, and Target dominated planned holiday shopping, with discount and club retailers also benefiting.

As retailers begin planning for the 2026 holiday season, early engagement, sharp value messaging, and strong essentials assortments will be critical, especially as consumers continue to shop cautiously.

What this means for retailers

The overarching message is optimization and discipline. Shoppers are value-focused, essentials-led, and pragmatic in store choice. Retailers that win in 2026 will be those that deliver competitive pricing, convenient access, reliable stock on core items, and targeted (not overwhelming) digital engagement. In a constrained environment, relevance and value are the ultimate differentiators.

Interested in meeting with the team to walk through the full report and findings? Reach out to Christine Ciullo or Jjuan White today to schedule a call:

Christine Ciullo christine.ciullo@toluna.com

Jjuan White Jjuan.White@Toluna.com

The latest wave of the shopper and retail tracker was conducted via Toluna Start and fielded between October 28 and November 10 amongst a nationally representative sample of 2,500 U.S. primary shoppers, adults 18+. The second wave of this study will be released in spring 2026.