Alcohol consumption is undergoing a quiet but significant evolution. Toluna wanted to further explore the forces behind the changing alcohol landscape and uncover what it means for brands navigating the future of drinking. Leveraging our first-party global panel and insights platform Toluna Start, we conducted a quantitative study among 2000+ US-based alcohol consumers.

In the first edition of our A new “Cheers” series, we’re sharing current drinking trends, motivations behind changing preferences, and the growing interest in alcohol alternatives.

Setting the scene

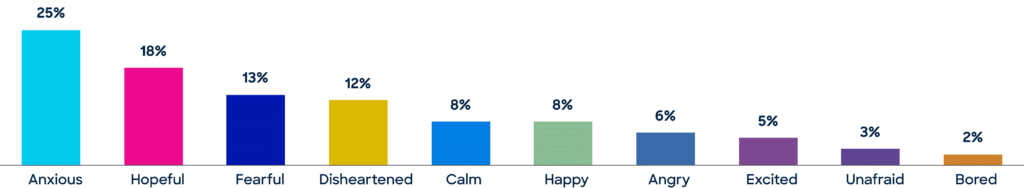

A growing sense of uncertainty and caution is shaping how consumers view the world and, consequently, how they engage with alcohol consumption. Our research revealed that 58% of alcohol consumers feel negative about the current state of the US and the world, with anxiety emerging as the leading emotion – particularly among Gen Z and millennials. By contrast, 42% express positive emotions, with hope surfacing mostly among Gen X consumers.

Feelings towards the future

For some, drinking is a way to cope with stress: 32% of Gen Z are drinking more, driven by a desire to relax and socialize. At the same time, there are growing barriers to consumption, notably health factors (41%), alcohol-related issues (22%), and economic strain (14%).

Using SmartCloud, our AI-powered open-end analysis tool, we extracted the predominant contributors to changes in consumption over the last year.

The impact of economic stressors

Nearly 1 in 3 consumers surveyed claim their mental health to be between fair and poor. Many cite the current economic & political climate as a reason to drink more. Inflation, the rising cost of living, and the recent introduction of tariffs are predominant contributors.

Tariffs on imported alcoholic beverages are emerging as a potential disruptor to consumption patterns, but feelings are mixed. 52% of respondents claim that tariffs will impact their drinking habits – 64% of which are Gen Z. This echoes a broader pattern of financial sensitivity among younger consumers facing rising costs and low disposable incomes.

Interestingly, there is a duality in the perception of alcohol in times of economic stress: emotionally charged and simultaneously economically negotiable.

The wellness wave remains strong

The way people produce, consume, and relate to alcohol are evolving in response to today’s realities. The rise of wellness culture and health-forward lifestyles, economic and political turbulence, and changing societal norms are collectively reshaping the alcohol category. For brands, this shift demands adaptation, innovation, and a deep understanding of changing preferences.

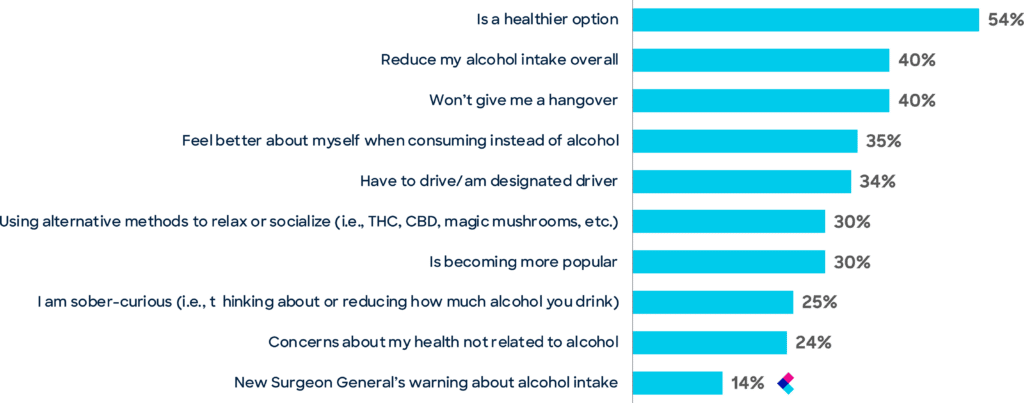

As health and wellness remains a priority, consumers are being more mindful about how much and how often they drink. Growing interest in low-alcohol, non-alcoholic, and wellness drinks highlights a shift towards intentional drinking.

Consumers positively associate wellness drinks with feeling better about themselves, making healthier choices, and supporting their mental and physical health. In fact, 85% of wellness drink consumers report drinking at least 1x per week, highlighting a strong sticking potential.

At the same time, there is a rise in non-alcoholic beverage consumption (i.e. mocktails and non-alcoholic beers). 54% of consumers say they opt for these drinks because they’re healthier, and 40% choose them for the reduced alcohol intake and the lack of hangovers. 35% say they feel better about themselves when they choose a non-alcoholic drink over alcohol.

In the next part of our series, we’ll share more about alcohol alternatives that are increasingly claiming space and examine how consumers are maintaining a balance between choice, control, and shifting priorities. Stay tuned!

Download the one-pager for a quick view of the 7 trends shaping the future of drinking or get in touch with adriana.sousa@toluna.com to learn more!