From functional buzz to emotional escape, how is alcohol consumption evolving?

Earlier this year, we launched « A new cheers« : a data-fueled content series on shifting habits, values, and choices that define how Americans drink today. Powered by a nationwide quantitative study of 2,000+ alcohol consumers via Toluna Start, our research set out to go beyond the buzz and track not just what people are drinking, but why.

Now, with the 2nd wave of the study complete, we’re not seeing static trends. We’re witnessing momentum across behaviors and attitudes, as well as some surprising shifts across generations. Let’s explore what’s holding steady, what’s accelerating, and what’s quietly disrupting the alcohol landscape.

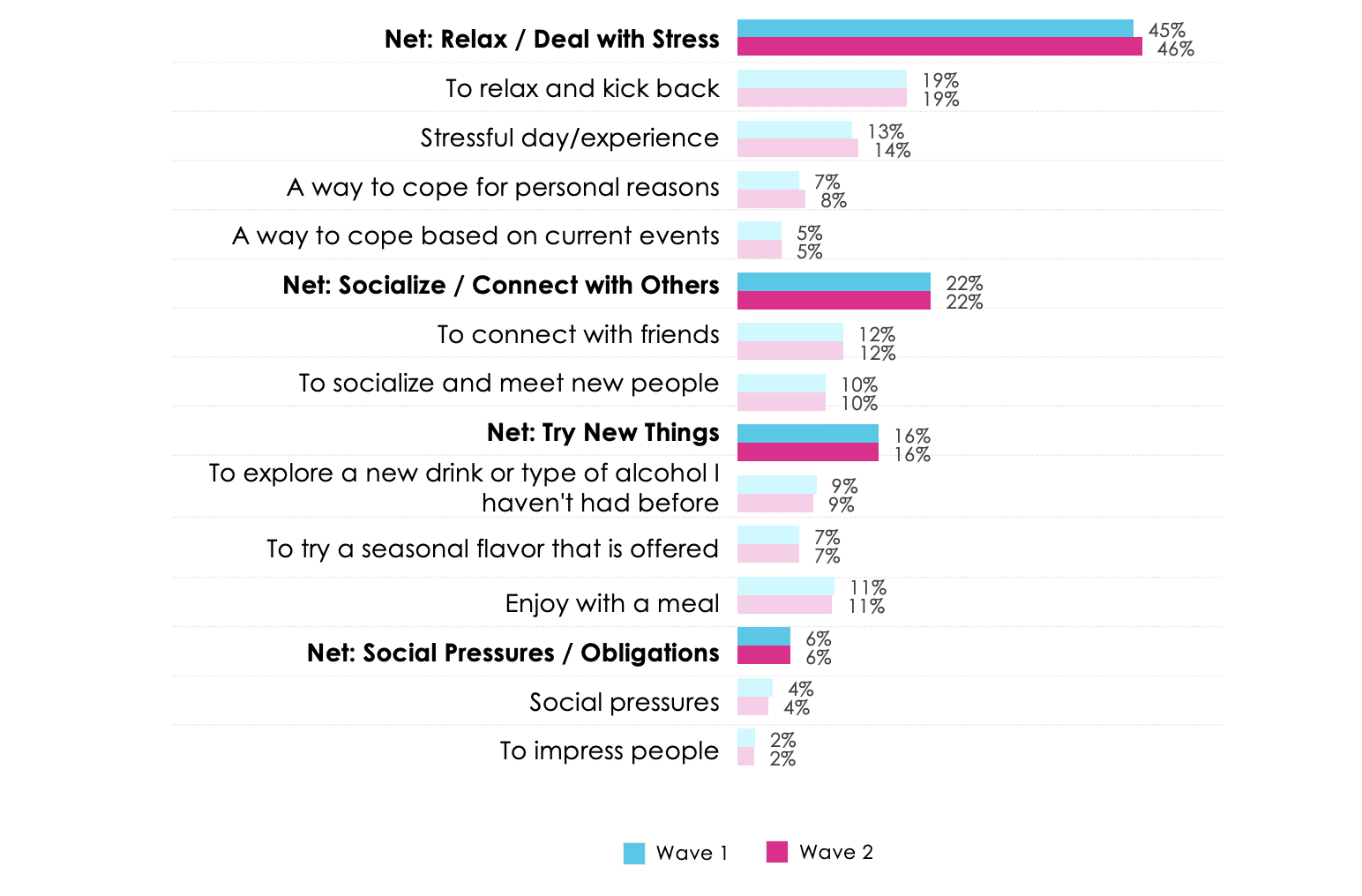

Steady trends: stress, sobriety & social connection

Emotional escape is still the top driver of consumption. Drinking to relax, cope with stress, and feel connected to others remains a key motivation. Across both waves, anxiety is the dominant feeling consumers have towards the state of the world, with 1 in 4 rating their mental health as fair or poor.

Cost continues to shape choices. Tariffs are a wildcard: half of consumers claim they would cut back if import prices rise. Wine is also losing ground, with 51% finding it too expensive (a sentiment especially strong among younger drinkers).

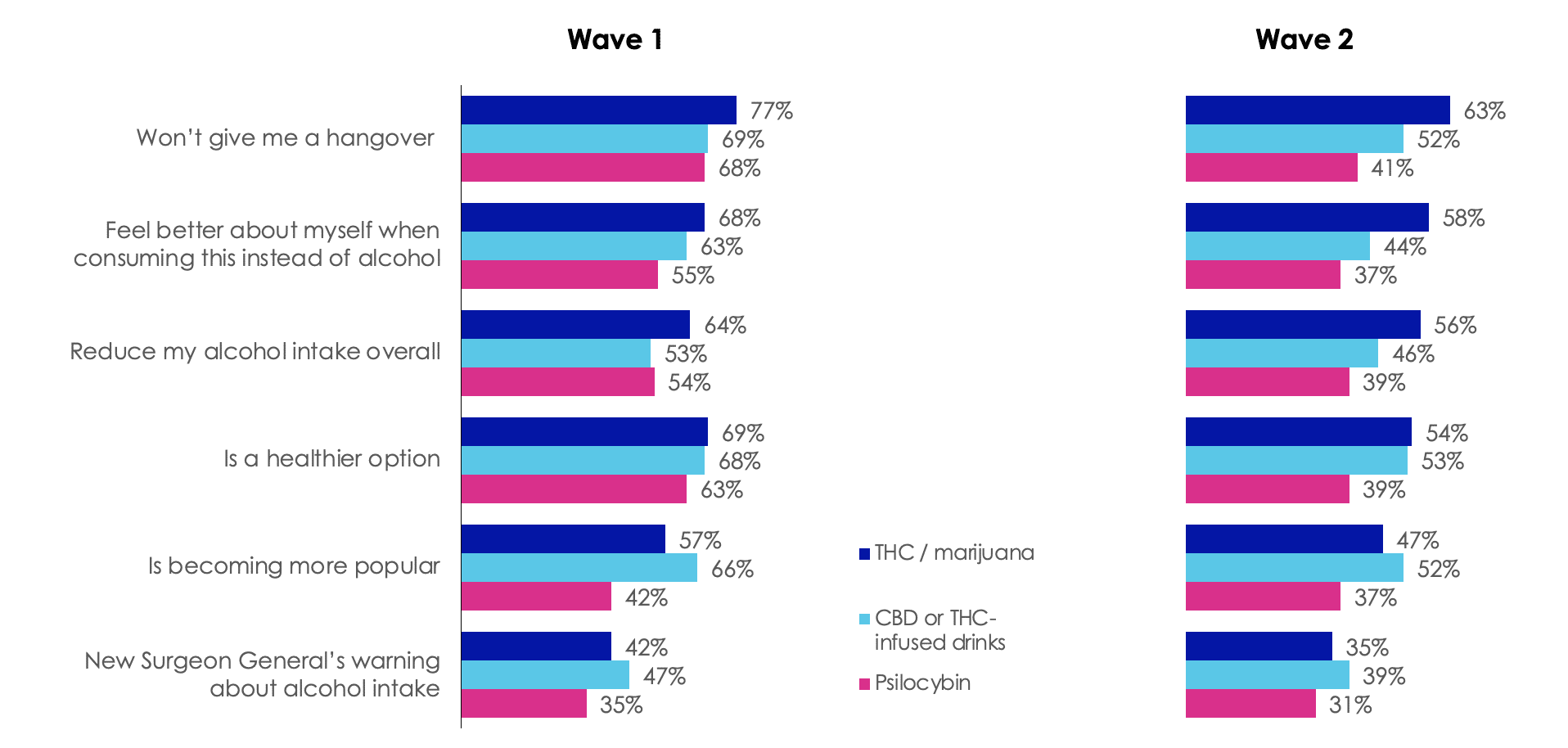

Health is the biggest buzzkill – and opportunity. Weight loss, hangover avoidance, and a desire to feel better are pushing people toward alternatives like THC, CBD-infused drinks, and non-alcoholic cocktails.

Sober curiosity is still trending; the non-alcoholic movement isn’t fading. In fact, 66% expect non-alcoholic cocktails to gain popularity, with Millennials and Gen X leading the shift.

Reasons to consume recreational drugs / infused drinks

What’s changing: Gen Z, wellness, THC, and Mind Shifts

Gen Z is drinking more and feeling worse. Contrary to the “sober generation” narrative, 35% of Gen Z have increased alcohol consumption. But they’re not drinking to party; they’re drinking to cope.

THC is seeing a modest increase, with 35% of consumers reporting usage (up from 31% in wave 1). Additionally, 64% of non-users say they are open to trying it, indicating a continued curiosity around cannabis-based products.

Psilocybin and mushroom-infused drinks show modest growth, signaling openness to exploration. Millennials are the most willing: from wellness drinks and non-alcoholic spirits to CBD and magic mushrooms, Millennials are redefining what ‘drinking’ means.

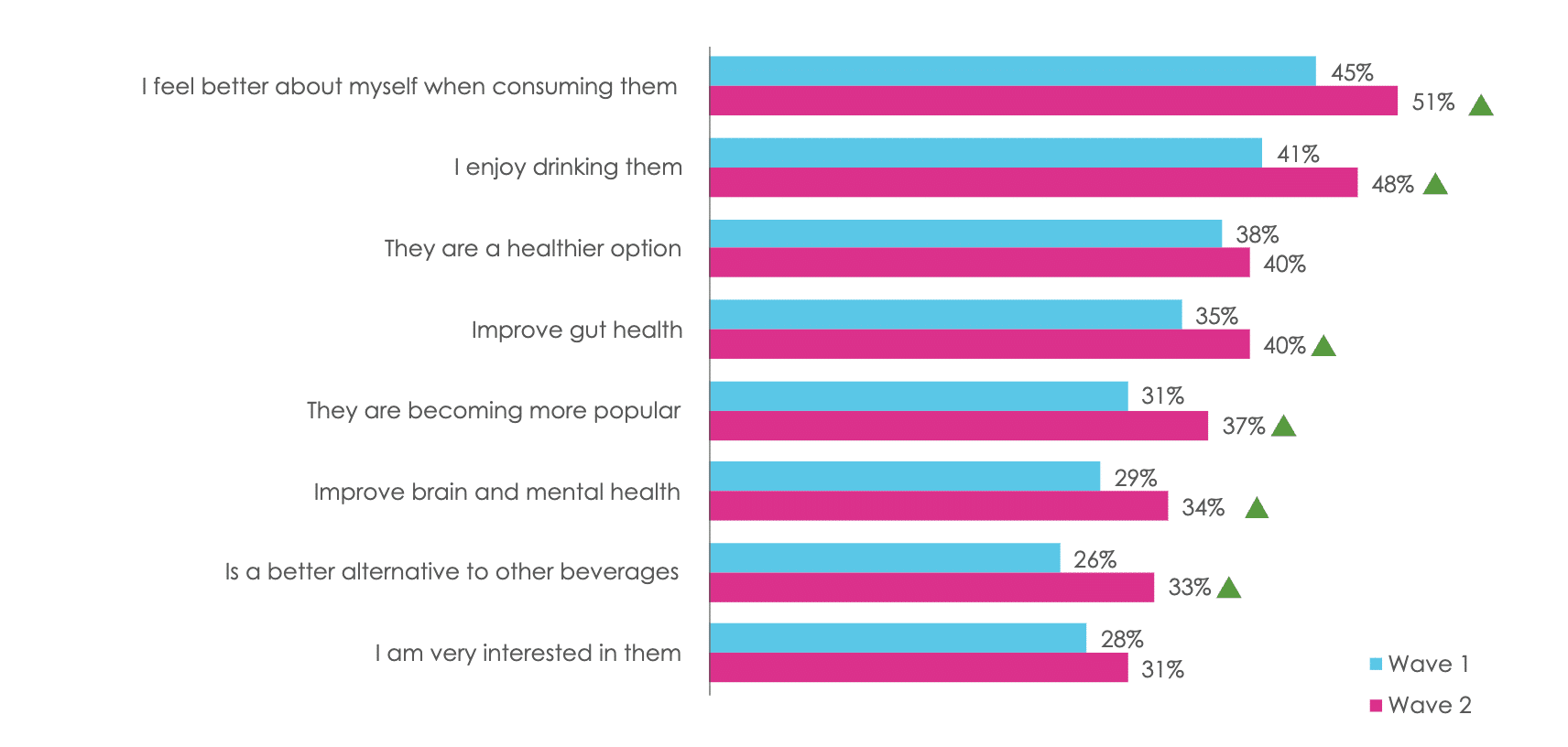

Wellness drinks have staying power. With 86% of consumers drinking them at least weekly, these beverages aren’t a trend – they’re a new category of habit.

Wellness / Functional Drinks Attributes

What this means for brands

Wave 2’s data suggests that brands have a clear opportunity to innovate and stay ahead of an industry in flux. Here are a few ways how:

Reformulate for relevance

Whether it’s lowering alcohol by volume (ABV), cutting sugar, or introducing functional ingredients, meeting consumers where their health goals are is no longer optional.

Go beyond the bottle

THC, mushroom-infused drinks, and nootropics are becoming legitimate lifestyle choices. There’s a whitespace in crossover branding that hasn’t been fully claimed yet.

Follow Gen Z closely (but don’t make assumptions)

While Gen Z is drinking more, they’re doing it differently. Emotional triggers, economic stress, and experimentation define their behavior.

Millennials are your testing ground

If a new category or crossover innovation has legs, Millennials are the ones giving it a shot.

The last sip

The New cheers study isn’t just capturing data; it’s mapping a cultural evolution. From relaxation rituals to substance swaps, we’re seeing a redefinition of what it means to unwind, celebrate, and cope.

Whether your brand sits squarely in spirits, is dabbling in non-alcoholic products, or dreaming of its first THC-infused drop, one thing is certain: staying still isn’t an option. Consumers are changing fast, and if you’re not watching closely, you might miss the wave entirely.

Stay tuned for wave 3 – the next round’s on us.

Download the one-pager for a quick view of the 5 trends in motion across this evolving market. Want to know more? Contact adriana.sousa@toluna.com.