The ninth edition of the FIFA Women’s World Cup took place in August and had millions of people from across the globe turning their eyes towards Australia. As with any event on such a global scale, many leading brands invested heavily in advertising to get in front of this large, diverse audience. However, in order to truly understand the return on such a significant investment, it’s critical that brands measure the impact through consumer research.

With the Matildas hosting the event for the first time, Toluna surveyed a nationally representative sample of 300 Australians and 300 New Zealanders—both before and after the games—for their thoughts on the 2023 FIFA Women’s World Cup and the brands that took center stage. Here’s what we found.

Soccer fandom experiences a World Cup bump

Seven in ten Australians watched the FIFA Women’s World Cup in some way, shape, or form, with 61% reporting that they watched on TV or Optus Sport. Fifteen percent of Australian respondents said they watched the games live at an out-of-home venue such as a pub or restaurant, while 8% attended live games and 7% attended live fan zone events.

Overall, people responded positively to the event. When asked to rate the degree to which the FIFA Women’s World Cup was ‘an event for people like me,’ 60% of Australian respondents either agreed or strongly agreed—a significant jump from 48% of those surveyed prior to the event. Seven in ten Australians agree that the FIFA Women’s World Cup promotes gender equality, and a whopping 86% agree that it inspires the next generation.

Brands at the World Cup

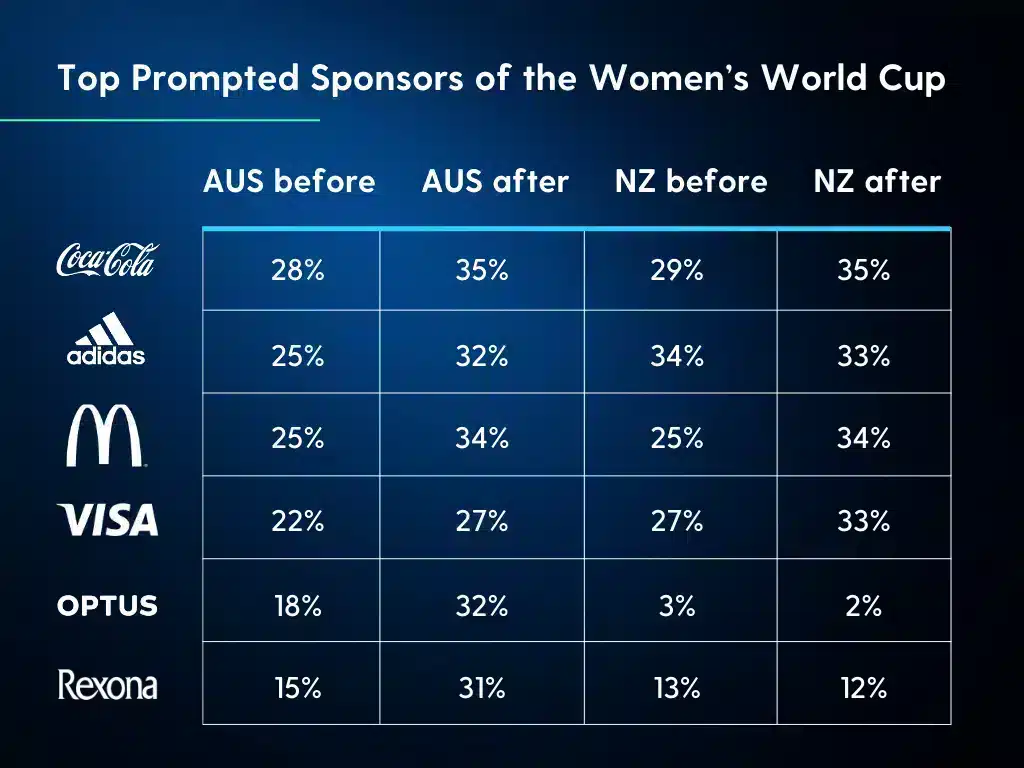

Before the FIFA Women’s World Cup commenced, we prompted respondents with a set of World Cup sponsors to gauge awareness leading up to the event, with global household names like Coca-Cola, Adidas, McDonald’s, and Visa leading the way in prompted recall. For the most part, these brands experienced an uptick when consumers were prompted to recall sponsors after the World Cup, as well.

However, we also noticed a large increase for Optus and Rexona. Whereas only 18% and 15% of Australian respondents knew of their respective sponsorships ahead of the World Cup, nearly one in three could recall these brands after the World Cup concluded.

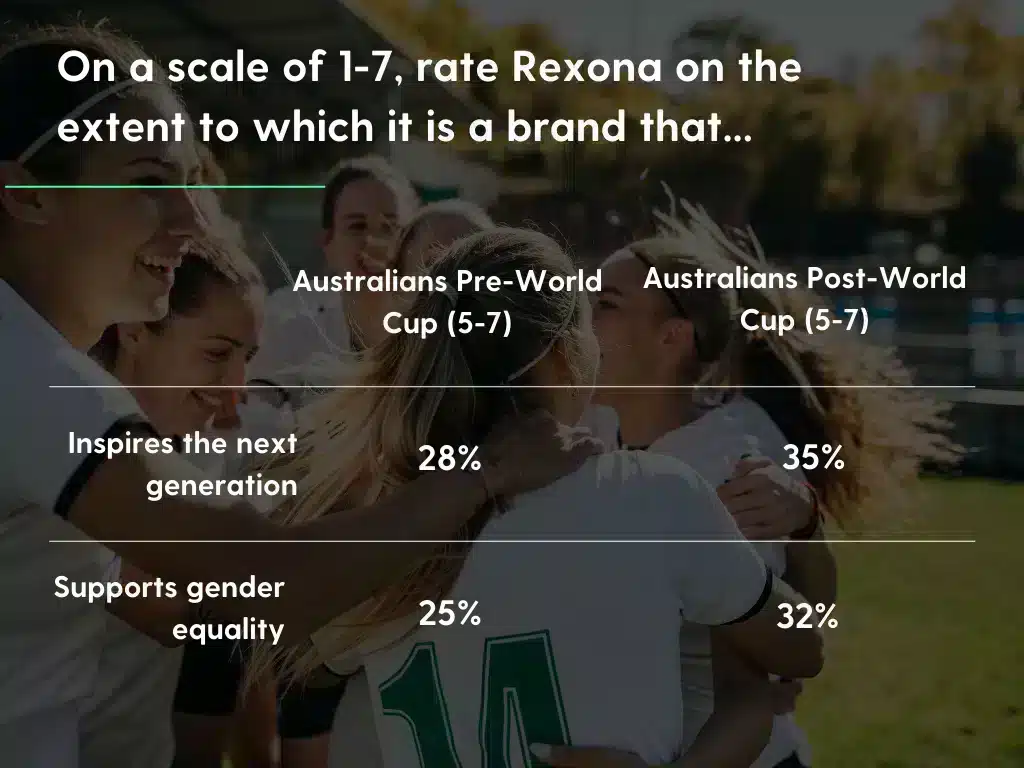

Rexona, in particular, aired a commercial called “Not Done Yet,” which celebrated Australia’s star captain, Sam Kerr, and her ability to continuously overcome setbacks in pursuit of greatness as she returned to the tournament from injury. The commercial resonated strongly with Australians, as there was a clear increase in positive sentiment regarding Rexona among respondents after the World Cup.

In fact, when we asked respondents which of the sponsors was the best fit after the event, Rexona ranked second among brands (13%) behind Adidas (19%) in the eyes of Aussies.

Brand tracking with Toluna

In our always-on, rapidly changing world, monitoring the performance of your brand and campaigns is as critical to success as ever. An insightful, impactful brand tracking program is your secret weapon for taking decisive action, driving brand growth, and winning market share.

With the recent additions of MetrixLab and GutCheck to the Toluna family, we’ve forged a powerhouse that draws from our deep collective experience in brand equity measurement, an industry-leading panel, global reach, and strength in technology. This enables us to design and build brand tracking programs that give our clients greater access to flexibility, agility, speed, and value. Each client works with our experts to build a brand tracking program that is exactly fit for their evolving needs and budget.

Re-designing your brand tracker? Seeking expert advice or a game-changing perspective? Your search ends here.