Consumers have continued to feel the impact of global inflation in 2023. How are they responding to the rising cost of living? And what are their expectations for the months that lie ahead?

The latest wave of the Toluna Global Consumer Barometer surveyed 15,848 consumers in 19 global markets to get to the heart of shifting sentiments and behaviors. Here’s what we learned:

As grocery bills rise, consumers seek ways to save

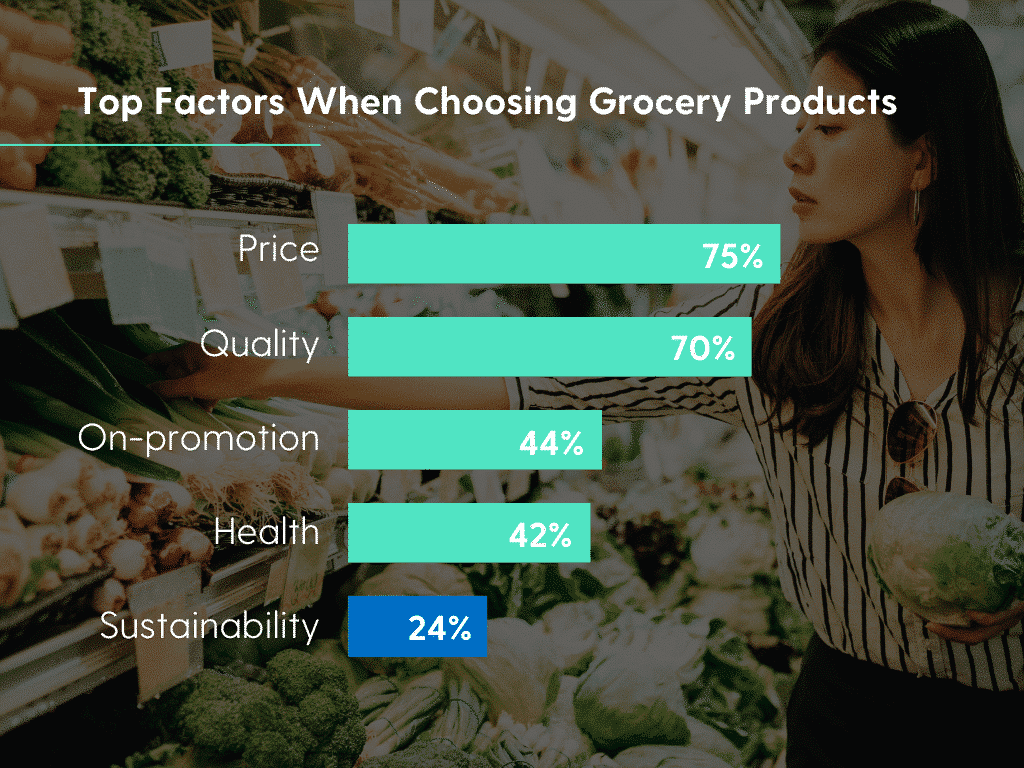

While 37% of global consumers expect to spend more on groceries over the next three months, they’re still looking for ways to mitigate the damage to their wallets. Three in ten say they will visit more stores in search of the best value, while about a quarter will switch to a cheaper supermarket (25%) or buy more own-label products (27%). Unsurprisingly, price is going to be the biggest driver of decisions.

While health and sustainability lag behind price and quality in importance amidst the economic crisis, there is still pressure for brands to do more to help consumers make positive and affordable choices for their health. Fifty-nine percent of global consumers would like to make more food and drink choices based on health factors, but can’t afford to, and three in four (73%) feel that food and drink brands should offer a better range of healthy products.

The economy’s effect on consumer well-being

Nearly four in ten (38%) global consumers say they feel more stressed due to the current economic climate, representing a rise from January 2023 (34%). And that stress is manifesting itself in various negative ways. Consumers are making fewer purchases in support of their health (21%); eating less healthy foods (21%); getting less exercise (17%); and being generally less health conscious due to other priorities (17%).

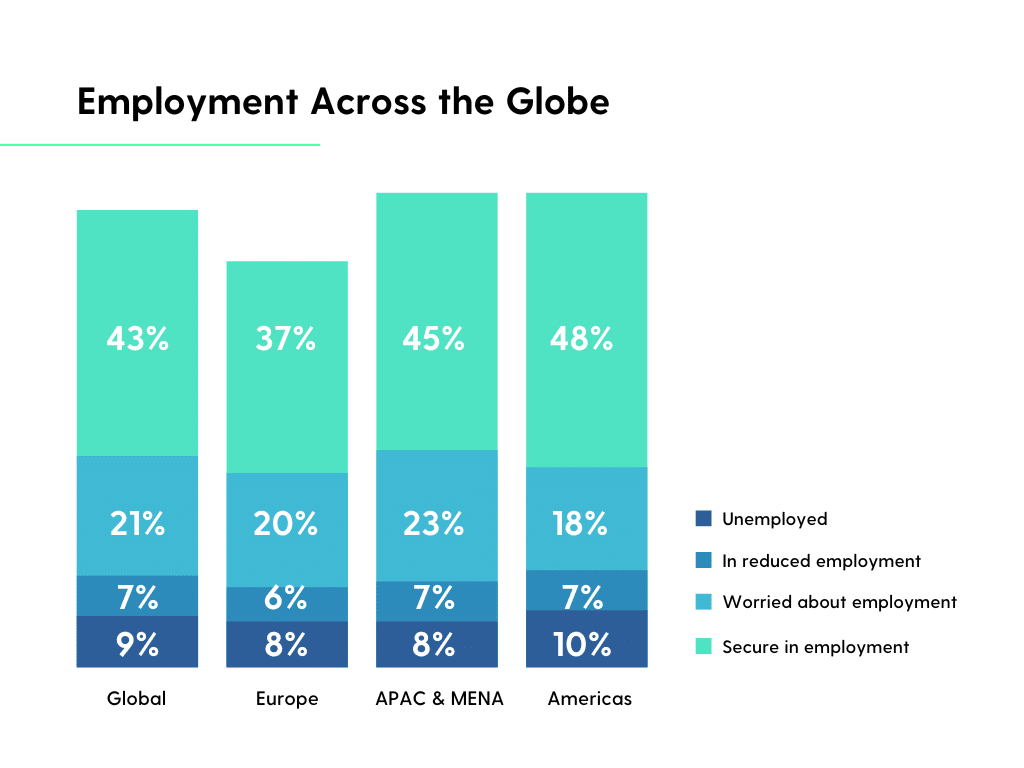

Additionally, many consumers have employment concerns. Thirty-six percent of global consumers say they are either unemployed, in reduced employment, or are worried about their employment. These concerns are most prevalent among younger consumers—rising to 42% when looking at those between the ages of 18-44, versus just 31% of those ages 45 and up.

Some consumers are cutting luxury goods. Others can’t live without them.

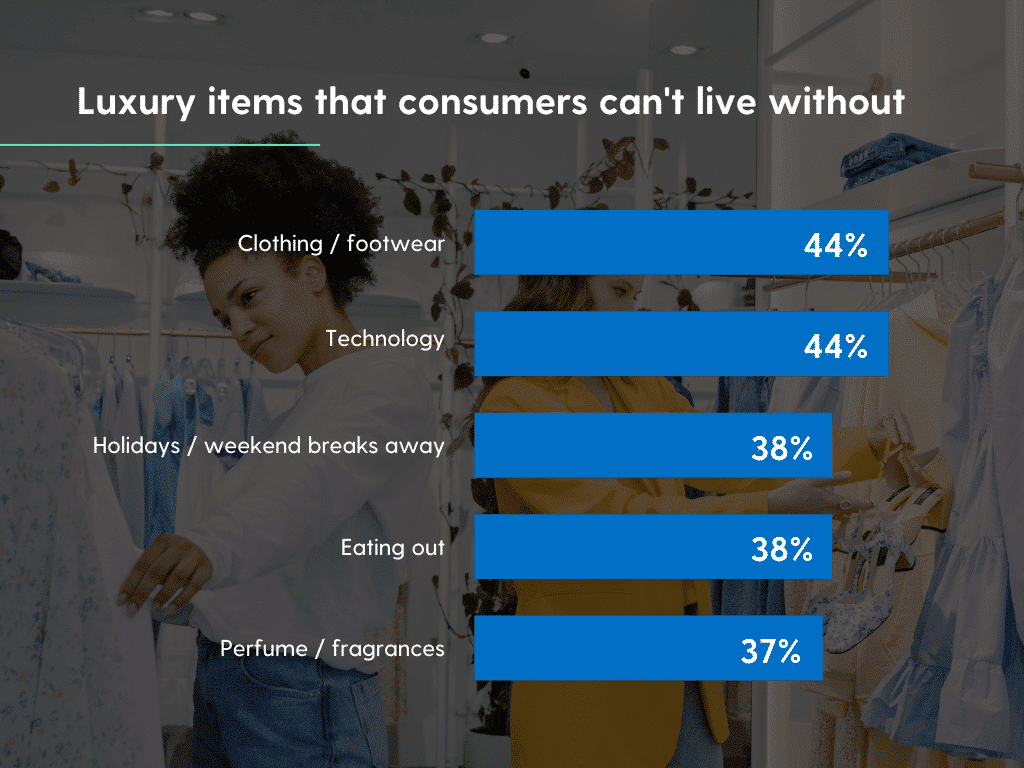

For many consumers across the globe, luxury goods and services are the first place they’ll look to cut spending. In fact, 41% say they’ll spend less money on luxury goods in 2023. However, that doesn’t mean it’s all doom and gloom for luxury brands. Thirty percent of global shoppers tell us that there are some luxuries they simply can’t live without, even during challenging times.

To this point, nearly four in ten (37%) consumers have bought luxury items in the past year or plan to buy within the next year. In terms of channel preference, luxury shoppers typically prefer to buy items in stores. Over six in ten luxury consumers buy their items in stores—whether that be brand operated locations or department stores—while just over half choose to buy from such stores online.

Optimism for the future despite present-day concerns

With more than a third (34%) of global consumers feeling that financial organizations have not been supportive enough in their response to the global economic crisis, the latest wave of the Barometer provides important insights for businesses looking to better support their customers.

Four in ten global consumers say they are very concerned about their personal financial security in current economic circumstances, representing a continued rise from 37% in March 2022 and 30% in May 2021. The concern is highest in the Americas (58%), which come in significantly higher than Europe (36%) and APAC/MENA (36%).

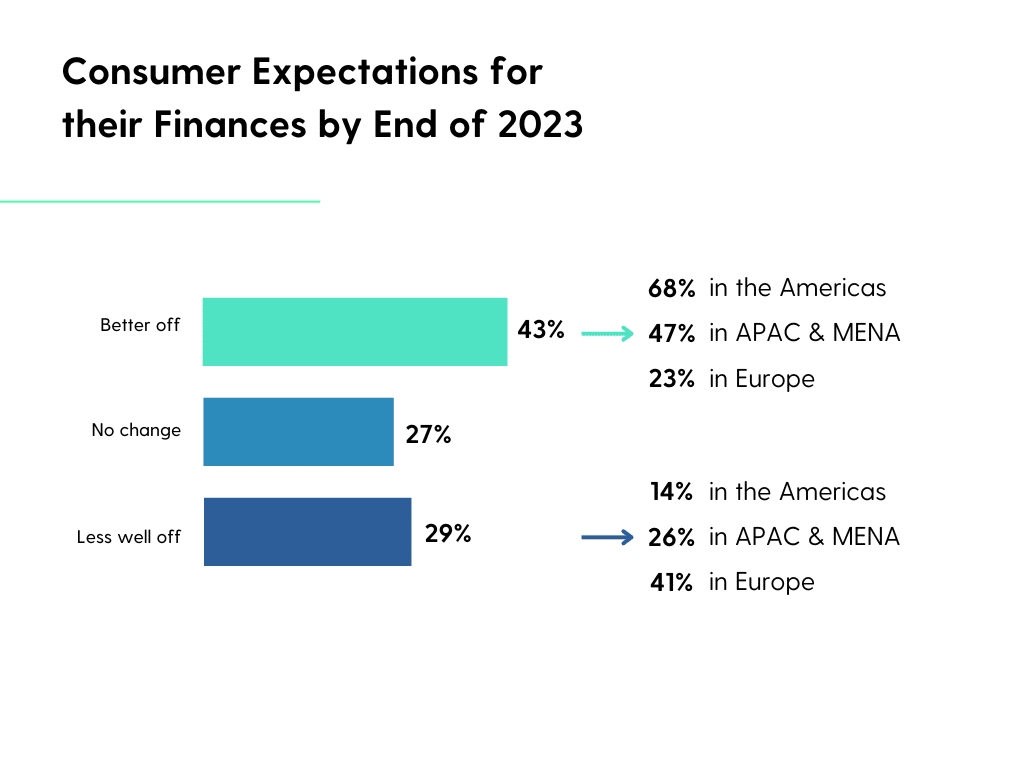

However, there are some signs of optimism, with 43% of global consumers believing their personal financial situation will improve by the end of 2023. Despite their overwhelming concerns about their personal financial security, confidence is highest in the Americas, where 68% of consumers think they will be better off by the end of the year.

Overall, the research shows that organizations need to continue to evolve their support for customers during times of economic hardship. Even as many respondents are optimistic about their personal financial situations, more than six in ten are postponing major life expenditures and half are cutting back on their spending. With consumers continuing to feel the impact of the rising cost of living, organizations must offer support and flexibility. That means it’s important to continually improve, evolve, and replace products to meet changing customer needs.

To learn more about shifting consumer sentiments and behaviors amidst the economic crisis, download your copy of Wave 22 of the Toluna Global Consumer Barometer here.