As the landscape of health and wellness continues to evolve, so does the retail environment. Today’s consumers are no longer just calorie counters or casual label readers – they’re strategic shoppers laser-focused on fueling their bodies with high-protein foods. They’re also navigating new territory with GLP-1 medications like Ozempic and Wegovy. For insights professionals at leading retailers, understanding these emerging consumer segments is essential to capturing market growth and brand loyalty.

From diet trends to retail disruption

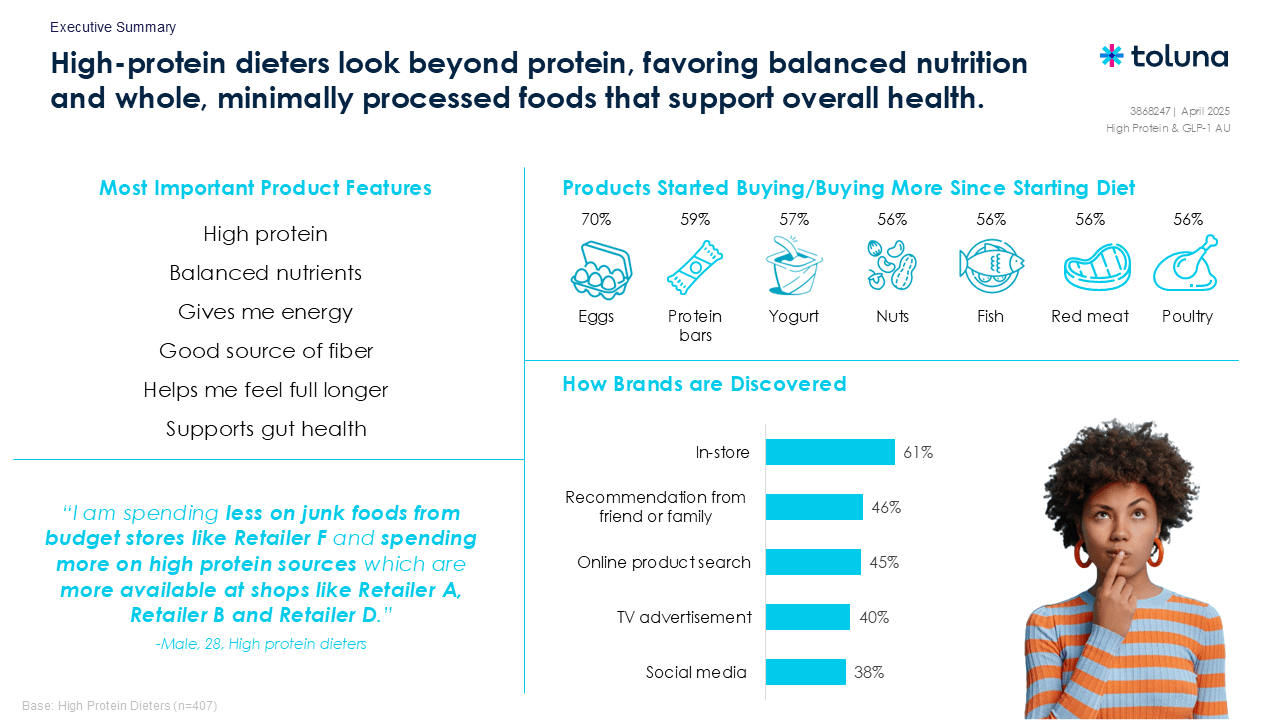

High-protein dieters have carved out a distinct space in the grocery aisle, favoring fresh meats, eggs, and nuts. This preference isn’t just about nutrition. It’s about reshaping shopping frequency, retailer selection, and brand loyalty. Many consumers now shop more often to keep fresh foods stocked, prioritizing retailers that offer quality protein at competitive prices. Consequently, larger retailers like Costco, Whole Foods, Trader Joe’s, and Walmart are seeing increased traffic as shoppers cherry-pick stores based on value and stock availability.

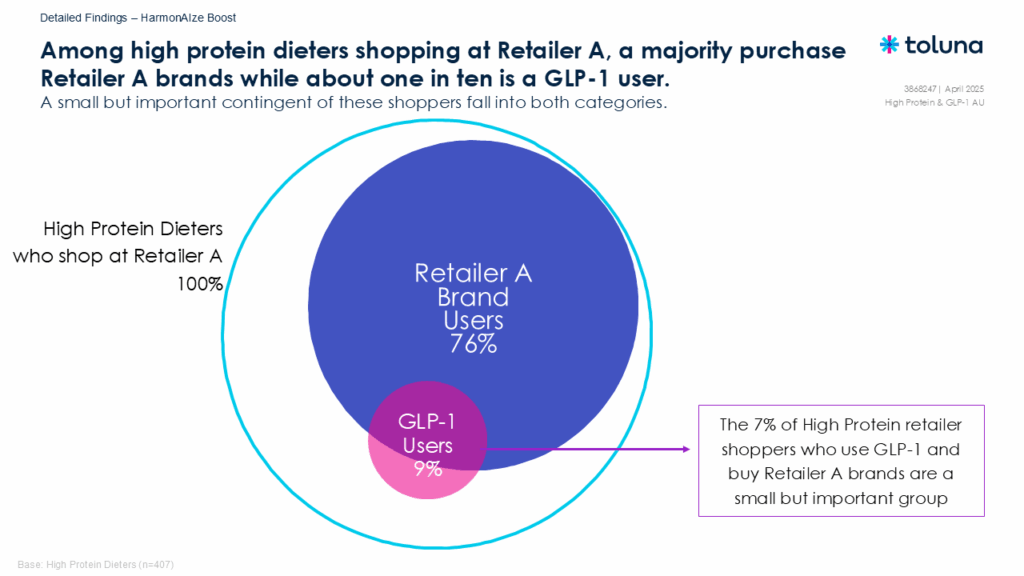

Simultaneously, GLP-1 users represent a rapidly emerging demographic with overlapping yet unique preferences. While their nutritional journey often begins for weight loss or diabetes management purposes, their shopping behavior reveals a deeper story. These consumers lean heavily on high-protein, high-fiber foods and are drawn to fortified products like shakes and protein bars from specialist brands such as Atkins, OWYN, and Elevation. Their loyalty, often formed during this transformative health phase, could have long-lasting implications for product development and brand strategy.

Taste, trust, and transformation

While health remains the guiding star, taste still reigns. Among GLP-1 users (especially those loyal to retailer-branded products) taste is a critical component of brand relevance. This creates an opportunity for retailers to invest in sensory appeal and flavor innovation, especially in categories like snacks and ready-to-eat meals.

High-protein dieters, meanwhile, are turning away from ultra-processed products in favor of minimally processed, balanced nutrition options. These shoppers want more than protein: they’re seeking energy, fiber, and real ingredients. Branding strategies that emphasize naturalness, quality, and health benefits are likely to resonate.

Retail implications

Retailers that act now – by expanding high-protein and fiber-rich product lines, enhancing taste messaging, and ensuring clear protein labelling – stand to win loyalty from both high-protein dieters and GLP-1 users. These segments may be niche today, but they’re trendsetters for the future of health-conscious shopping.

For insights professionals, the takeaway is clear: evolving health behaviors are driving more than personal transformation. They’re reshaping the retail experience.

Get in touch for a copy of the full report

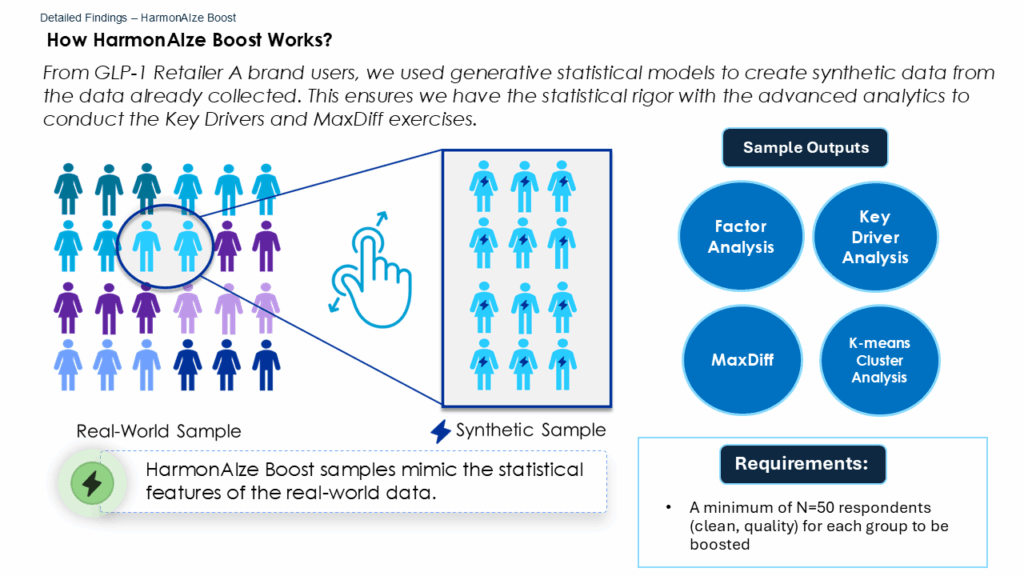

Some of the key insights within this report were only feasible thanks to our innovative HarmonAIze Boost methodology. Using generative statistical models (not large language models), HarmonAIze Boost amplifies insights from small or low-incidence samples by generating synthetic data that statistically mirrors real-world patterns. This approach allowed for robust key driver analysis, and MaxDiff testing, especially among hard-to-reach groups like GLP-1 users purchasing specific retailer-branded products.

By harnessing this advanced analytics framework, the study illuminated the true motivators of brand relevance, revealed unmet needs, and spotlighted opportunities for product innovation, insights that traditional methods might have missed due to small sample sizes or data sparsity.

Contact us for a copy of the full report and to understand more about how you can leverage HarmonAIze Boost to unpack shifting consumer priorities with precision.