In early 2024, consumers across the globe continue to face familiar challenges in the form of global uncertainty and the high cost of living. How are they responding to these ongoing pressures? How confident are they that things will improve as the year goes on? Where are they making the biggest changes to spending and lifestyle choices? And what do all these changes mean for brands?

The latest wave of the Toluna Global Consumer Barometer surveyed 16,824 consumers in 20 markets to get to the heart of shifting sentiments and behaviors. Here’s what we learned:

Cautious optimism amongst consumers

It’s no secret that the cost-of-living is affecting consumers across the globe. In fact, just over a quarter of respondents tell us that they are confident spending money right now. Another four in ten say they’re very concerned about their personal financial security, and 38% say they are either worried about their employment, in reduced employment, or unemployed.

However, that doesn’t mean it’s all doom and gloom. Forty-four percent of consumers tell us that they are very optimistic about the future, and that optimism extends to their feelings on personal finances. When we asked respondents to predict how their financial situation will evolve over the next three months, 37% said they expect to be better off, outpacing the 24% who expect their financial situation to worsen.

Spending choices and trade-offs

Two in three global consumers say that rising energy and living costs are impacting their spending. As a result, 58% say they will be putting off big life expenditures until the economic climate is more stable. But it’s not just major expenses that they’re heavily scrutinizing. When we asked respondents which activities they would cut back on to save money in the coming year, discretionary expenses like luxury items and social activities rose to the top.

Where won’t they compromise? The bare necessities. Forty-two percent of global consumers said they would not cut back on groceries to save money, while utility bills (23%), everyday healthcare products (20%), and personal care/hygiene products (20%) follow behind.

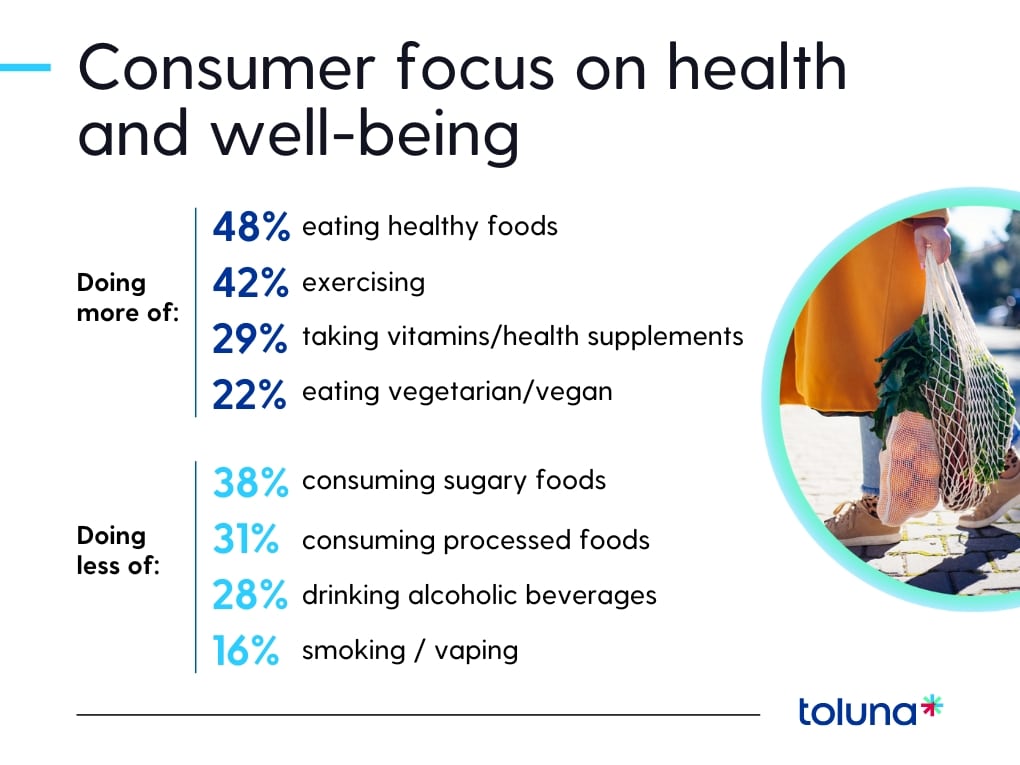

Consumer focus on health and well-being

Nearly half of global consumers (47%) say that the rising cost of living is impacting their health and well-being. While this represents a slight improvement since September 2023 (50%), it still means a vast amount of people are struggling in the current economic environment. Despite these challenges, 50% say they are focusing on their health and well-being more in 2024. What actions are they taking to address this?

People are taking matters into their own hands, but they still expect brands to do their part to make it easier to focus on their personal health and well-being. When we asked them how brands could provide better support, three in four said brands should offer a better range of healthy products. The exact same proportion also said that brands should provide better information on the health and well-being implications of their products.

Environmental, social, and ethical considerations for today’s consumers

It’s clear that financial concerns are top of mind for people across the globe, but that doesn’t mean they’ve stopped caring about brand values. Three in four consumers feel it’s either just as important or even more important that brands are socially responsible in the current economic situation. People feel satisfied when they make socially responsible choices (75%) and they like to be informed about the values of the brands they use (66%). Many have started using a brand or used it more because of its positive activities (61%), and a similar proportion have stopped using a brand because of its negative actions (55%).

Of course, it’s not always that simple. Two in three consumers (64%) want to make decisions based on these factors, but feel they don’t have enough information, and others say they simply can’t afford to do so (62%). The key takeaways for brands? Communicate your values clearly, stick by them, and enable consumers to make values-based decisions by making these choices more affordable.

To learn more about shifting consumer sentiments and behaviors in the current economic climate, download your copy of Wave 24 of the Toluna Global Consumer Barometer here.