Children’s health has become the top priority for many parents since the outbreak of the pandemic in 2020. As a result, parents are highly focused on the quality of snacks for kids because of their direct impact on nutrition.

To get an in-depth understanding of the current market outlook for the category snacks for kids in China, KuRunData, the leading provider of real-time consumer insights in China under the Toluna group, conducted a quantitative study of 400 mothers with children from ages 0 to 6, as well as a community discussion of 60 parents.

Buying habits have changed in China

There is no doubt that consumer purchase behavior has gone through massive shifts in recent years. In KuRunData’s study, the majority of the Chinese mothers say that they are now more discerning about the quality of snacks and shifting their purchase channels. Not only has stockpiling become a habit to ensure sufficient supplies for unforeseen circumstances, but they’re also shopping online more frequently and paying more attention to domestic brands.

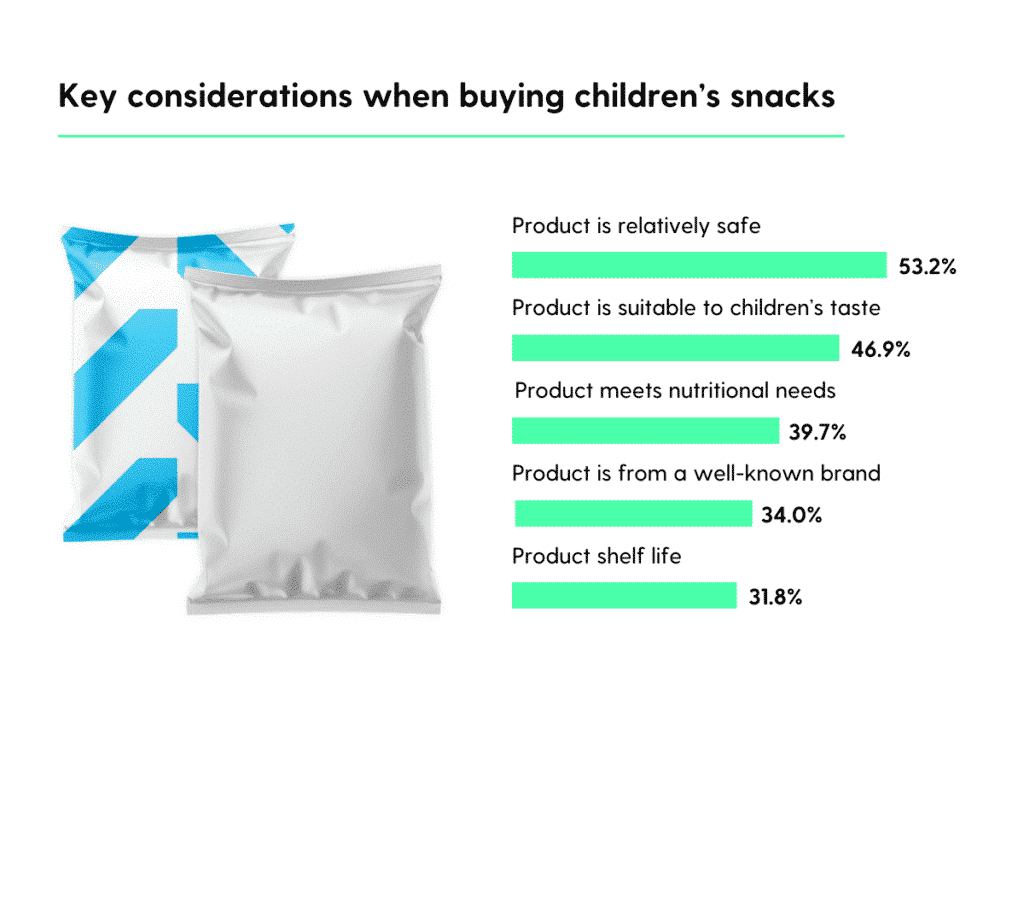

What key factors are parents considering when choosing snacks for kids? More than half of respondents (53.2%) say they favor products that they consider safe. Apart from food safety, there are few surprises. Ultimately, parents are looking for products that meet the taste and nutritional needs of their children.

Despite the shift in buying behavior, brands can still leverage different channels to effectively reach Chinese mothers and stay top-of-mind. Chinese mothers are gathering snack-related information through both online and offline channels, with short-form video platforms and Xiaohongshu reported as the most popular channels. What specific types of content are they looking for? Most of all, they’re looking for product reviews or introductory information (51.2%), followed by maternal training guides (42.1%), and free trial reviews (41.6%).

Post-85s and post-95s mothers

When we look at mothers from different generational cohorts, we see some notable differences in purchase behaviors that inform how brands should approach each group.

When asked about their ratio of purchasing online versus offline, younger mothers in the post-95 (born between 1995-1999) cohort favored online shopping. Nearly two-thirds (64.9%) of respondents from that age group said they do at least 60% of their shopping online, as opposed to about half (48.4%) of the post-85 (born between 1985-1989) cohort.

Younger mothers also are more open to children snacking at an earlier age. Half of post-95 respondents expose their children to snacks within one year from birth, while only 45.6% of the post-85s’ children consumed snacks at the same age. However, post-85 mothers are willing to spend more money on snacks for kids than their younger counterparts. Two-thirds of post-85s spend 200 yuan or more on snacks per month, whereas just half of post-95s spend the same amount.

Brand awareness and market outlook

Among Chinese consumers, there has been a shift in the perception of foreign brands versus domestic, with more and more parents in China favoring domestic brands.

• When asked why they now favor domestic brands, they noted:

• Domestic brands are more suitable for the nutritional needs of Chinese children

• Improved quality of domestic brands, strict food safety supervision, and more value for money

• Accessibility of domestic snacks during the pandemic

• Desire to support domestic brands with the poor economic environment

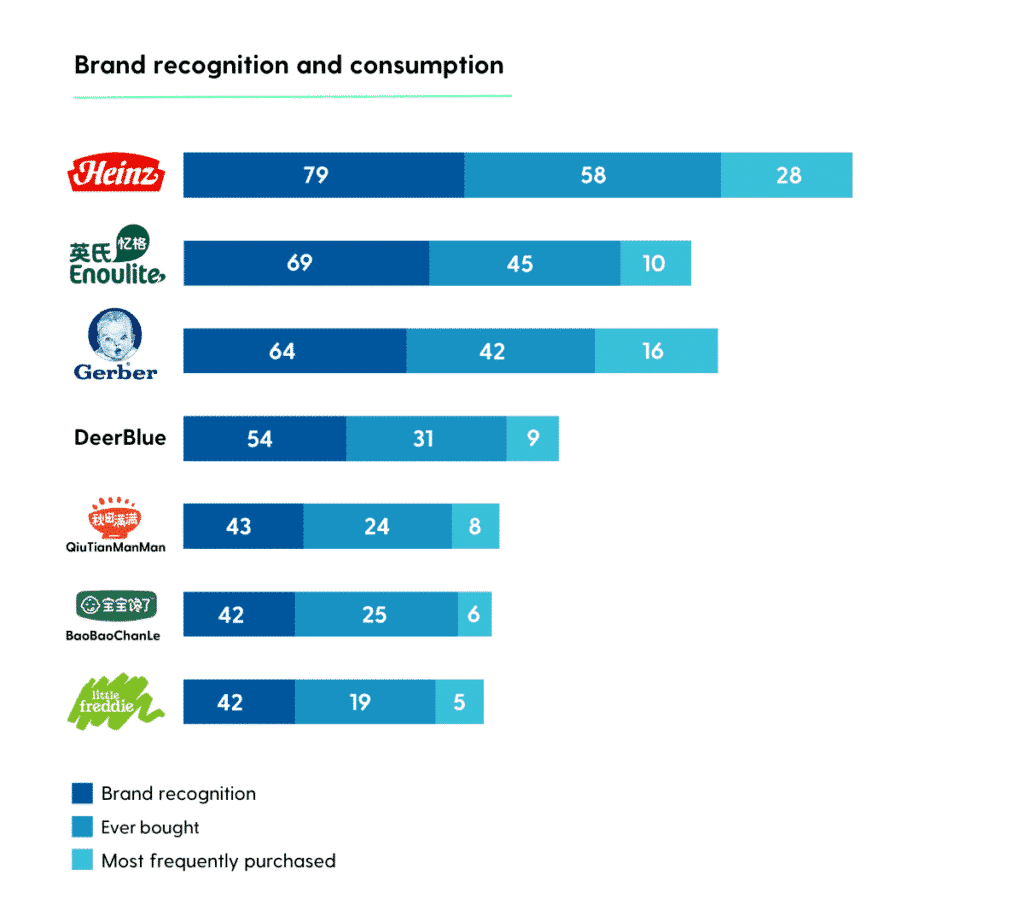

Despite the shift in perception, foreign brands still maintain competitive brand awareness in China. When asked an unaided awareness question about foreign and domestic children’s snack brands, Heinz was top-of-mind for 18.6% of respondents, followed by Enoulite (11.1%), QiuTian Manman (10.2%), Gerber (9.1%), DeerBlue (7.3%), Little Freddie (4.3%), and BaoBaoChanLe (3.9%).

The study also looked further into aided brand awareness and brand loyalty. Among the most-recognized brands, Heinz, Gerber, Enoulite, and BaoBaoChanLe have been among the most widely purchased, while Heinz, Gerber, and QiuTianManMan have shown the strongest ability to earn repeat customers from those who have purchased.

While Chinese mothers are generally satisfied with the snack market in terms of choices, taste, and finding options that their children enjoy, they still would like to see improvements in preservatives used, value, and the variety of functional snacks.

If you’re interested in learning more or checking out more in-depth local studies from KuRunData in Chinese language, visit KuRunData.com.