With an estimated 950+ million smartphone users, China is the world’s largest smartphone market—and a fiercely competitive one, at that. Despite Apple reclaiming the throne of the top smartphone seller in Q4 2021 for the first time in six years, domestic brands still possess a strong foothold in China. In fact, a recent KuRunData study found that 75% of respondents expect their next smartphone to be domestic.

In such a competitive landscape, it’s critical for brands to keep up with consumers in real time. That’s why KuRunData, the leading provider of real-time consumer insights in China under the Toluna group, fielded a survey of 1,000 Chinese smartphone users who intend to replace their current phone. In the study, which was fielded between February 28th and March 1st, we sought to understand the market outlook, sentiments around domestic versus foreign brands, and key factors that drive purchase decisions.

Domestic brands are taking over

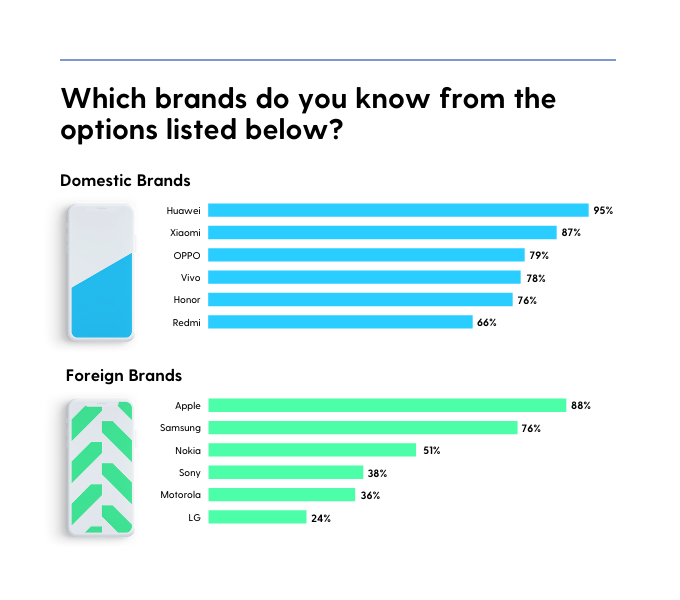

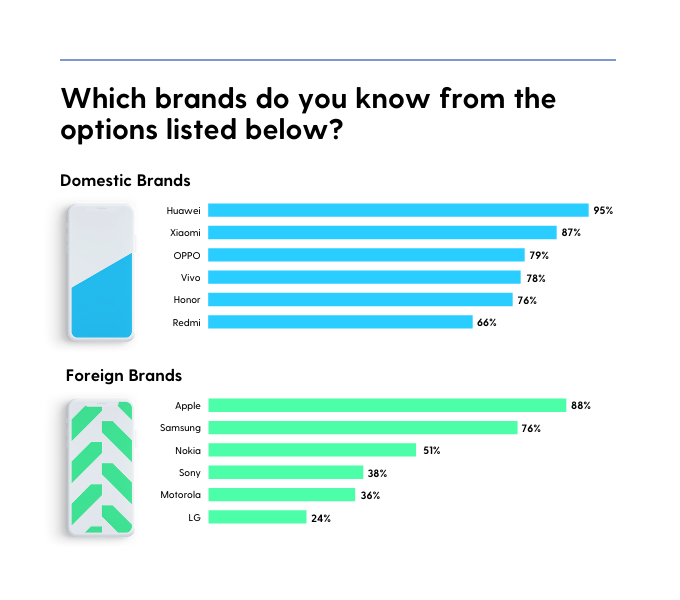

Brand awareness is the one clear advantage that domestic brands possess in this highly condensed, competitive market. In general, domestic brands are more recognized on the home front than foreign brands.

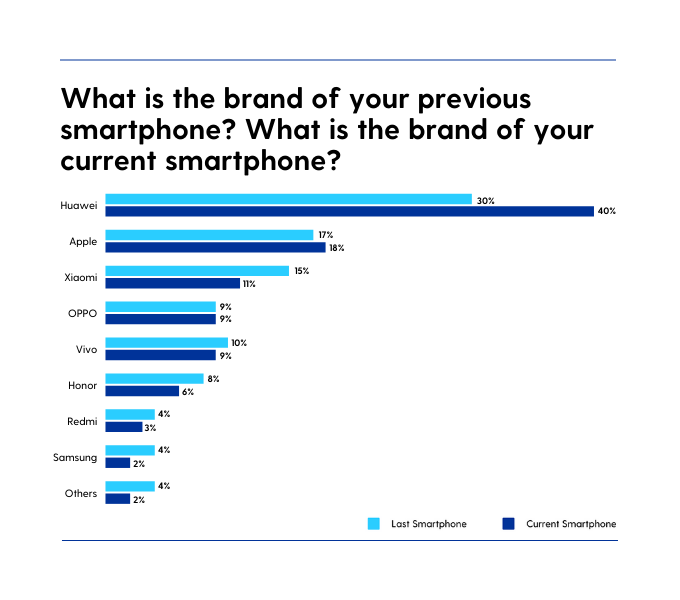

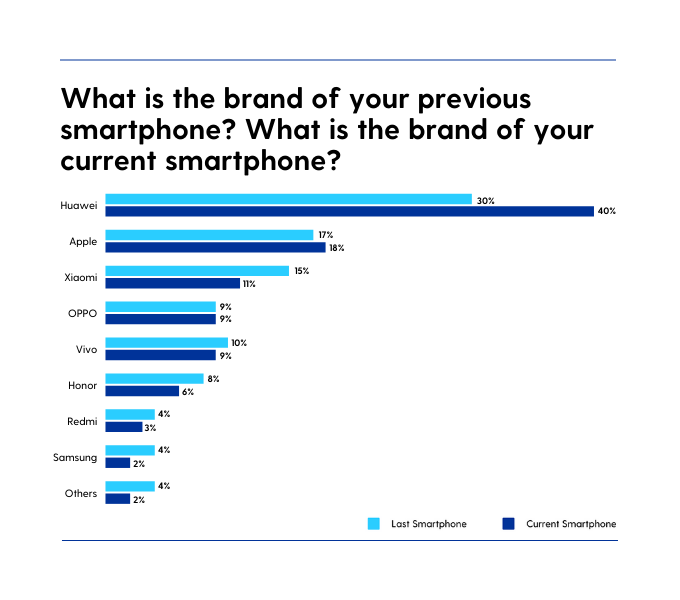

When comparing previous smartphone brands to current ones, there is a notable shift towards domestic brands, with Huawei seeing the highest increase. Apple is the only foreign brand that shows an increase—and a small one, at that.

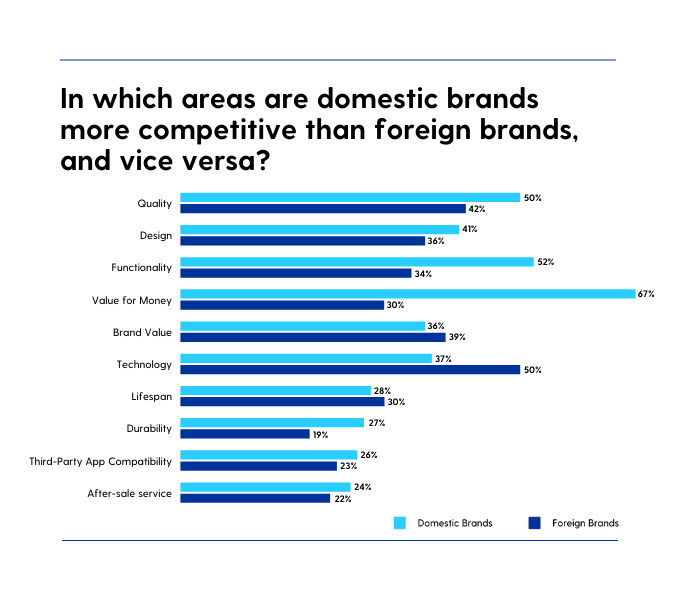

Though nationalism is often regarded as key driver of many homegrown brands success in China, they have other strengths that win over the hearts of Chinese consumers.

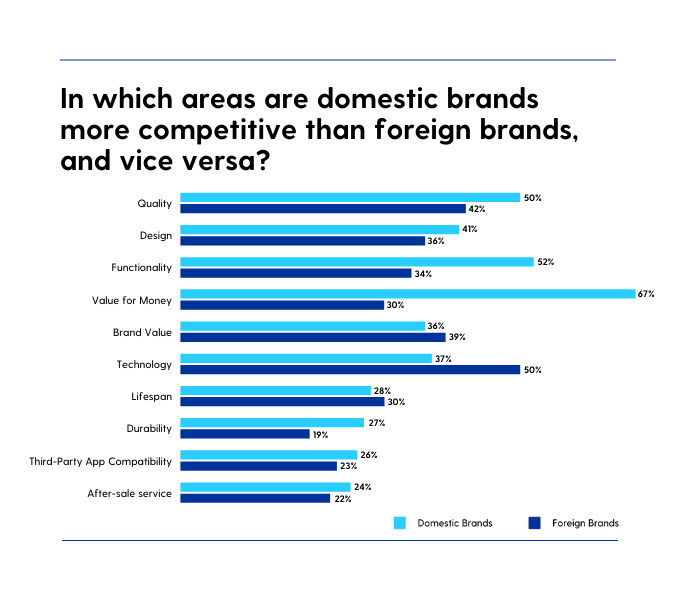

In general, domestic smartphones are more competitive in terms of value for money, functionality, and quality, while foreign smartphones are competitive in term of more advanced technology and longer lifespan. When asked about the development of domestic smartphones in the future, 95.6% of respondents said they are optimistic.

Consumers are rational when it comes to replacing smartphones

On average, how frequently do consumers replace their smartphones? Despite the fast pace at which brands are replacing models, consumers aren’t following suit. Our study found that nearly 60% of respondents replaced their smartphones after 18 months or longer, on average. Only 20% replaced their phones in less than 12 months, and 2% replaced them within six months.

What drives consumers to replace their phones? Respondents were most likely to cite storage limitations (31%) or a deterioration in performance such as lagginess (30%) or battery life (28%). There are also early adopters who get attracted by new features (20%), upgraded models (19%), and compatibility with 5G (16%).

Going forward, many consumers will look to spend less on their next smartphones than they did on their current ones:

• 47% of respondents expect to have a budget of under 3000 Chinese Yuan for their next smartphone, a sharp increase from 23% who had this budget for their current phones

• Only 13% of respondents expect to have a budget of over 5000 Chinese Yuan for their next smartphone, a sharp decrease from 30% who had this budget for their current phones

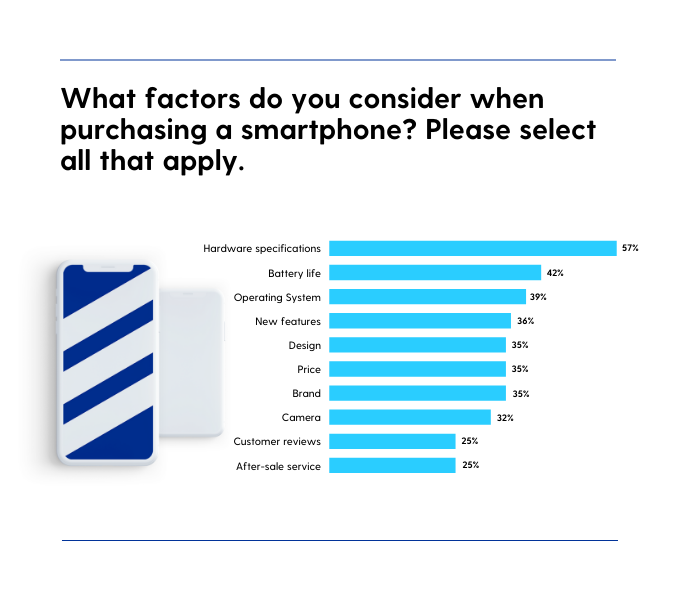

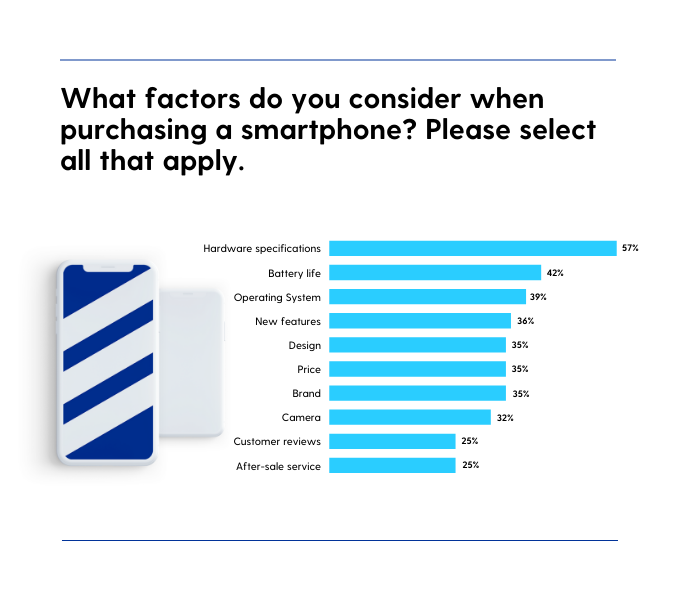

What are the influential factors in choosing a new phone? More than half of respondents ranked hardware specifications as most important, followed by battery life.

Omnichannel is the way forward.

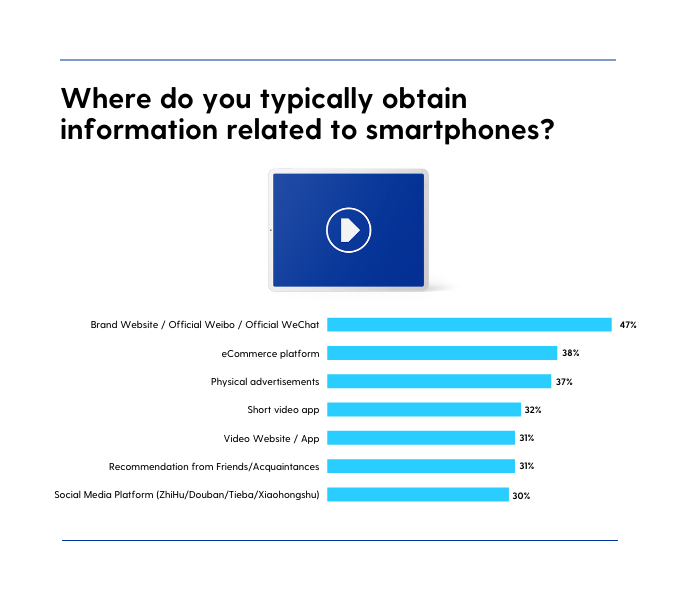

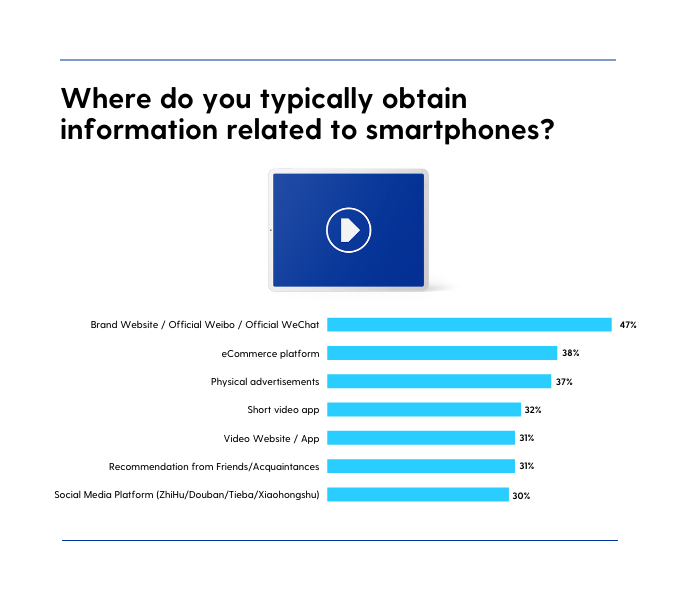

When asked about purchase channels, three in ten (30%) respondents said they purchased their phone through an ecommerce platform such as JD or Tmall, and 19% purchased from a brand’s official website. While the majority of respondents purchased online, there is still a sizable portion of respondents (21%) who bought their phones in-store. But what about where they get their information?

Beyond official brand websites and social media accounts—which are the fastest and most reliable ways to obtain information—consumers also look to ecommerce platforms and physical advertisements to learn more about smartphones. This continues to demonstrate the importance of integrating both an online and offline approach to remain at the forefront of consumers’ minds.

As the smartphone market in China continues to evolve, it’s imperative to stay on top of changing consumer behavior and sentiments. If you’re looking to transform the way you collect consumer insights and get a deeper understanding of your target market, contact us today and start knowing.

Toluna is the parent company of KuRunData, the leading panel community in mainland China. Together, we push market research toward a better tomorrow.

Back to Blog

Back to Blog