In recent years, younger Chinese consumers have demonstrated a love of specialty coffee that has driven the industry’s growth in a country known to be dominated by tea culture. To better understand the market outlook going forward, KuRunData, the leading provider of real-time consumer insights in China under the Toluna group, conducted a study on coffee preferences and consumption habits of 1,000 ‘Post-90s’ consumers. This cohort includes Chinese consumers born between 1990 and 1999—and they are shaping the future of coffee culture in China.

Beverage Market Outlook in China

In China, the coffee industry faces competition in the form of bubble tea, which is also known as milk tea. Bubble tea’s popularity has been well-established in China and among post-90s consumers, so the coffee industry is looking to steal market share. Where do they stand in comparison to each other at this time? When asked about the beverages that they have purchased and consumed over the last three months, post-90s consumers were more likely to have consumed bubble tea (59%) than coffee (54.2%).

However, the popularity of coffee varies by city tier. The growth of the specialty coffee market is most concentrated in more developed cities and expanding towards lower-tier cities across the country. In fact, the findings show that coffee consumption has passed that of bubble tea in first-tier cities (Coffee: 65.4% vs. Bubble Tea: 58%), whereas the competition is near-even in new first-tier cities (59.9% vs. 60.8%), and slightly behind in second-tier cities (48.7% vs. 60.1%).

Overview of Today’s Coffee Consumption Habits in China

Of those who consume specialty coffee, nearly 40% say they drink a cup of coffee daily; and not just during the weekdays. Nearly four in ten (38.5%) say they consume coffee throughout the week, while 39.6% consume it occasionally on weekends.

What types of coffee are most popular? Over eight in ten (82.3%) say that they have consumed fresh-brewed coffee the most in the past three months, followed by instant coffee (70%) and ready-to-drink coffee (49.9%). Among those who consumed fresh-brewed coffee the most, more than half (55%) get their caffeine fix at large coffeehouse chains, which shows a strong foothold in the market.

When we asked respondents the top reason they consume coffee, 45.9% pointed to the energy boost. Apart from the physiological effects of drinking coffee, social factors are paramount, too; one in four (26.3%) feel that coffee elevates their lifestyle quality, and one in five view coffee as a necessity for socialization.

Factors Driving Coffee Purchase in China

The product itself is the most important factor when it comes to choosing which coffee to purchase; nearly 90% of respondents rated factors surrounding product taste, country of origin, ingredients, and more as the main factors. This was followed by brand (70.2%) and marketing activities (28.6%).

When asked to rank the top three ‘countries of origin’ from which respondents are willing to buy, Brazil (44.7%) was the most popular, followed by Switzerland (37.9%) and China (38.4%).

Brand awareness and market outlook

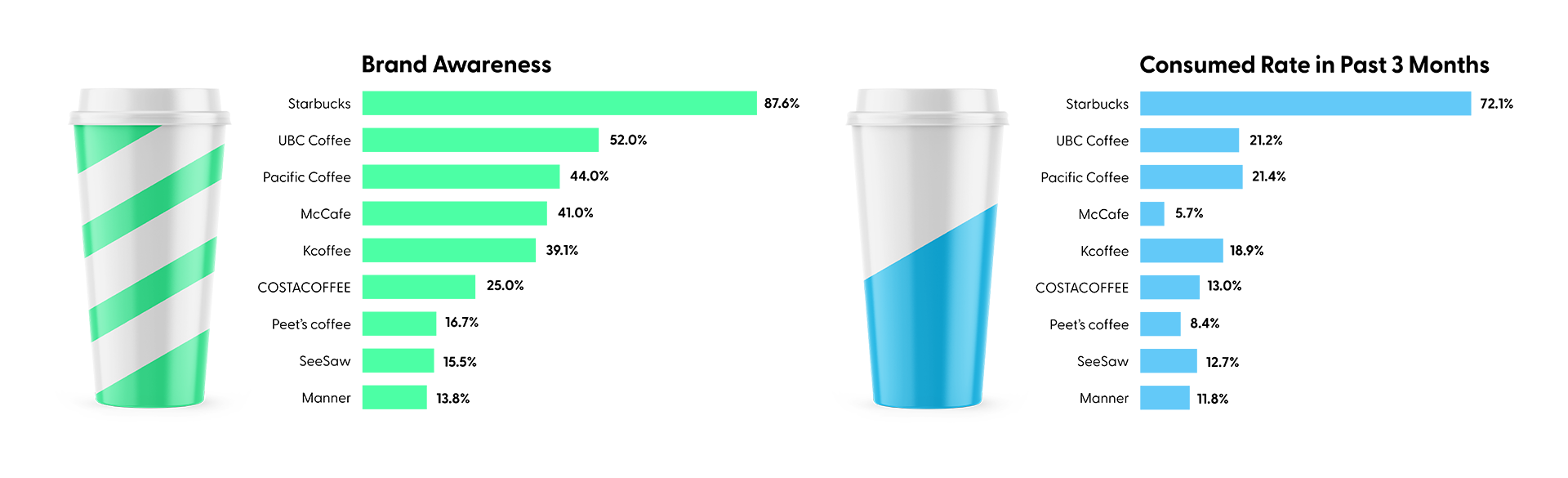

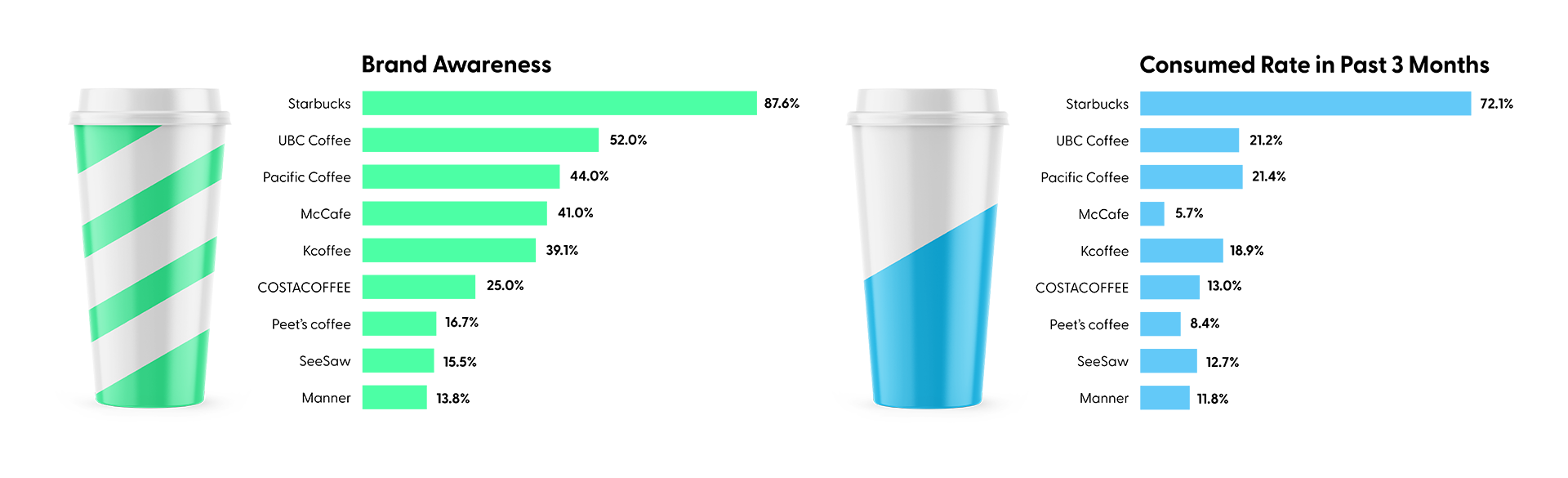

The freshly-brewed coffee market is dominated by industry giants, which possess strong brand awareness among young consumers. Starbucks, in particular, stood out in terms of brand awareness, with 87.6% of respondents recognizing the brand. Accordingly, when asked about the brands of freshly-brewed coffee that they purchased and consumed in the last three months, more than seven in ten (72.1%) cited Starbucks.

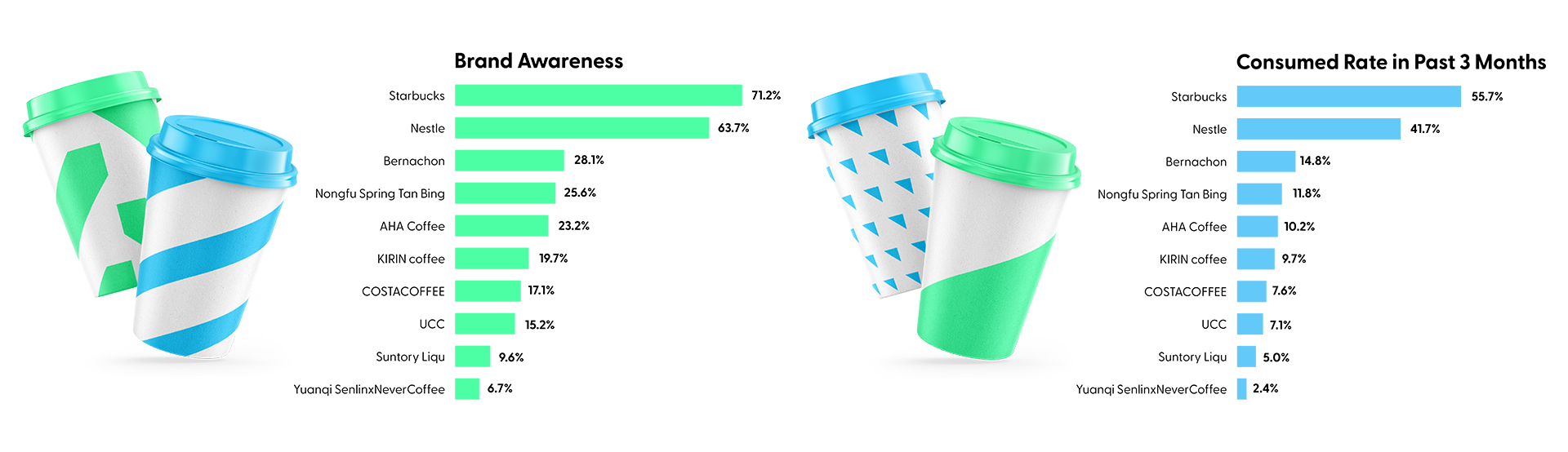

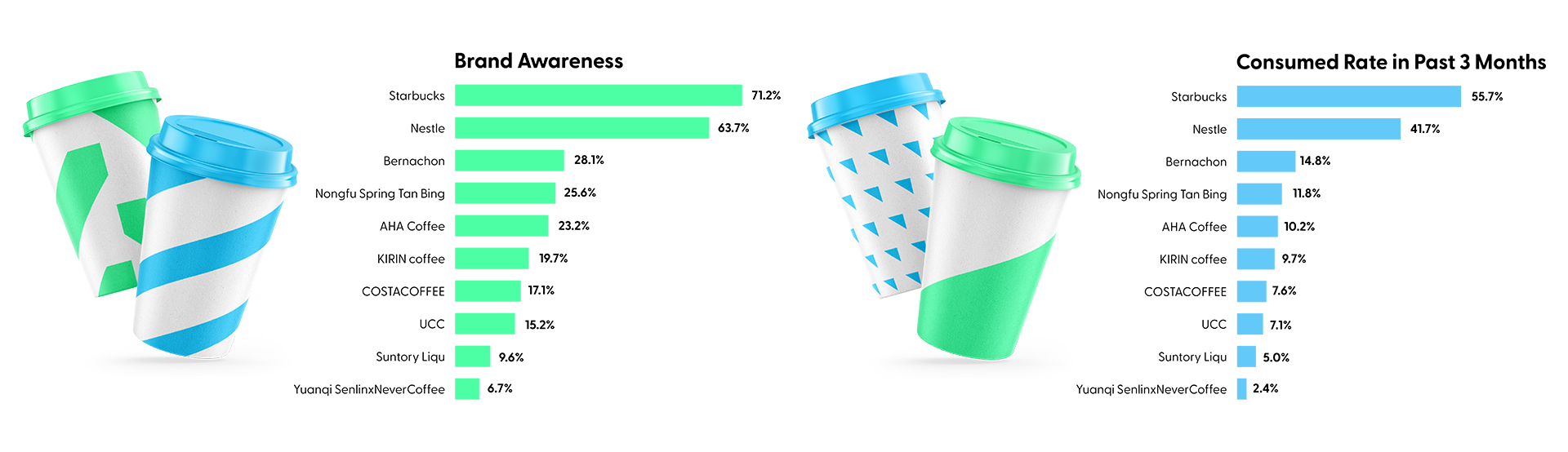

Within the ready-to-drink coffee segment, Starbucks is also ranked first in terms of awareness and rate of recent purchase. However, the study revealed the RTD segment is in the heat of the battle.

Despite lower brand awareness in the RTD category, Japanese products were most popular when we asked respondents to rate recently consumed brands on a scale of 1-10 for taste, mouthfeel, efficacy, packaging, and cost-effectiveness.

With coffee culture set to continue growing among younger Chinese consumers, it’s crucial to stay aligned with consumer preferences. If you’re looking to transform the way you collect consumer insights and get a deeper understanding of your target market, contact us today and start knowing.

Toluna is the parent company of KuRunData, the leading panel community in mainland China. Together, we push market research toward a better tomorrow.

For more in-depth local studies conducted by KuRunData in Chinese language, visit KuRunData.com.

Back to Blog

Back to Blog